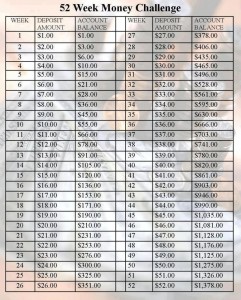

The events of the past year have made it plainly clear to me that I need to get back to the basics, which includes focusing on emergency preparedness! Since I started using coupons, I have had a pretty extensive stockpile of personal care items and food items. Having that stockpile had a huge impact on our budget because we weren’t buying things on a regular basis and I could meal plan around items we had on hand. When we were hit with financial surprises (including my husband being unemployed for awhile), we were able to rely on our stockpile. My stockpile isn’t what it used to be and one of my goals this year is to focus on rebuilding that. My other goal is to focus on making sure we have cash on hand for emergencies. If you know much about Dave Ramsey, one of the first things he recommends is a $1,000 Emergency Fund and we do have that, but I look at that as “sacred” and don’t want to use it unless we actually do have an emergency that we can’t cover. If you’ve ever been through any sort of natural disaster, though, you know that for the first few days afterward, systems may be down and many places, including gas stations and grocery stores, operate on a cash only basis, so having cash on hand is important, too. I came across this 52 weeks Savings Plan on Pinterest and I think it’s PERFECT for helping us to save cash to have on hand for emergencies and I will also use some of it for our Christmas savings.

The first week of the year is over, but you only need $1 to get started, and I think most of us can come up with that (if not, look in your couch, your car, or in the laundry room!).

SAVINGS IDEAS:

Here are a few things that I plan to do this year to add to my savings:

REBATES/CASH BACK:

Ibotta – if you haven’t heard of Ibotta, you get cash back for buying select grocery or personal care items at your favorite grocery or drug stores! Right now, they are also offering a $5 bonus just for signing up! (this bonus is only available through 1/11). I have earned $15 in the past week with my bonus and by purchasing products at my local grocery store! Find out more about Ibotta and register for your $5 bonus here–> Ibotta Registration

SURVEYS: these are all reputable survey companies that I have personally used!

- Register for Survey Spot here–>Survey Spot registration

- Register for Opinion Outpost here–>Opinion Outpost registration

- Register for Global Test Market here–>Global Test Market registration

- Register for Valued Opinions here–> Valued Opinions registration

- Register for Toluna here–> Toluna registration

This is a quick and easy way to jump start your savings:

Sadly this offer is not currently available. I will let you know when it’s back!

FOOD STORAGE

My other goal this year is to re-build our personal food storage. I found a few different programs that help you to build up your food storage by purchasing items on a weekly basis. I think that you have to look at what “works” for you and your family when doing this, but this at least gives you some ideas for getting started!

The two plans above both recommend buying laundry detergents and bleach this week. There is a GREAT deal on Tide this week at Kroger (especially if you have the $1.50 off coupons) and there is also a great deal on All at CVS.

This list tells you how to build your food storage on $5-$10 per week–> Building Your Food Storage on $5-10 per week

I’ll be updating you on my savings progress and food storage progress each week in my Savings Saturday post! I can’t wait to hear about your progress, too!

*This post may contain affiliate links. Please refer to my disclosure policy for more information

I just saw this at a perfect time. When my husband now out of the army and not getting many hours at work, i was searching for something to help us out, i will be following this all year lol. Thanks for this!

I have also started the 52 week money challenge. But, being a teacher and only getting paid once a month, I am usually very low on money by mid month. So instead of going in order week by week, I am skipping around with my biggest payments the first two weeks and lower payments during the last 2 weeks. That way I don’t have to worry with coming up with $52, $51, $50 and $49 in December 🙂

I have also started the 52 week money challenge. Instead of going in order week by week, I am skipping around with my biggest payments the first two weeks and lower payments during the last 2 weeks. That way I don’t have to worry with coming up with $52, $51, $50 and $49 in December 🙂

I have started this and can’t wait to have y savings for black friday!

Every penny counts. When I come home from the grocery store I take the money saved in coupons and put it aside for special purchases. I love the idea of saving something every week.

Good idea. I am going to check out the savings plan on Pinterest.

I really want to pay off debt and build up our savings this year. We did the dave ramsey plan a couple years ago and were in such a good spot and then we got off the habit and things spiraled. This year we committed to getting back on a budget and paying off debt and building savings.

loved this when i saw it….I’m starting with week 52, so come christmas time i’m not looking for around $200 for my jar. I’ve nicked named it the “Stud fund” this amount would cover the cost of buying all the studs to building our dream house.

Great ideas Sue!! 🙂

I am so thankful that you posted this! I think it is a great way to have a little bit of money saved up for those unexpected things that may pop up or to use for Christmas. It shouldn’t be too hard to find a dollar to save here and there. Thank you so much!