If you’re like me, you’re always looking for easy ways to make some extra money! Right now, ING is offering a $50 bonus when you open an Electric Orange checking account! This would be a GREAT way to start off your 2012 Christmas account!

I have been banking with ING for 8 years now. I have savings accounts for each of my kids there and that is also where we keep our “sinking funds” for things like Christmas, family vacations, and even our escrow payments! I love the ING Electric Orange checking account because it makes it easy for me to access the money from my sinking funds using my check card! During the holidays, I transfer the money from our Christmas fund into my ING checking account and use my card to make holiday purchases!

Click here to open up your ING Electric Orange checking account and get your $50 bonus–>ING Electric Orange checking account $50 bonus offer

Here’s how you can grab your bonus:

- Click on ‘Apply Now.’

- Open Electric Orange and make a total of 3 Card purchases or Person2Person Payments (or any combo of the two) within 45 days of account opening.

- Your $50 bonus will automatically be deposited into your account on day 50.

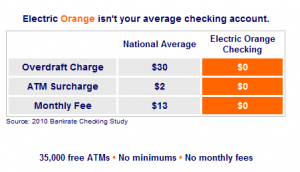

Here are some of the benefits offered by ING:

*This post may contain affiliate links. Please refer to my disclosure policy for more information